Albert: Budgeting and Banking

Albert: Budgeting and Banking App Info

-

App Name

Albert: Budgeting and Banking

-

Price

Free

-

Developer

Albert - Budgeting & Banking

-

Category

Finance -

Updated

2025-12-12

-

Version

10.0.23

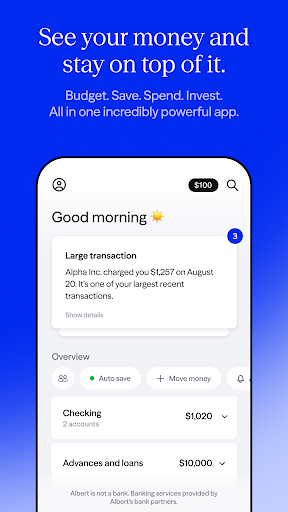

Core Features

- The app features an intuitive budgeting tool that tracks income and expenses with ease.

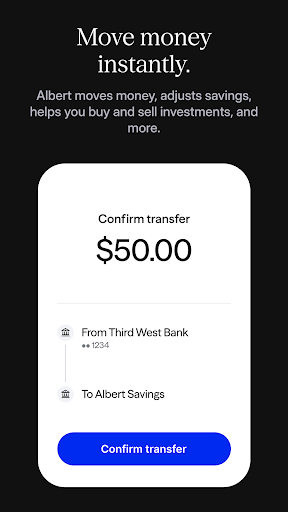

- Real-time sync across devices ensures your financial data is always up-to-date wherever you are.

- Secure bank connect functionality allows seamless integration with your bank accounts for automatic updates.

- Among app features, custom alerts help you stay within your budget and avoid overspending.

- The offline mode lets users access financial information even without an internet connection.

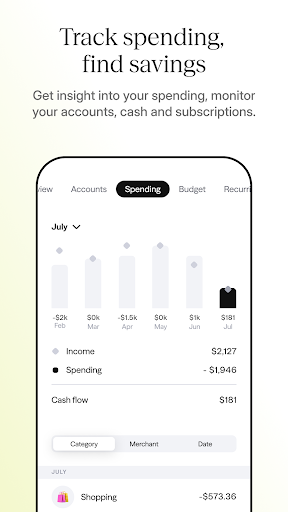

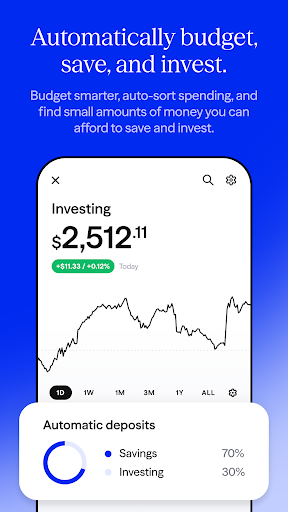

- An analytical dashboard provides insights into spending patterns to help plan better financial goals.

- This launcher app offers a clean, easy-to-navigate interface that enhances the overall app experience.

Who This App Is For

This mobile app is designed for individuals aged 18-45 who want a simple, reliable app-based solution for managing personal finances.

It's perfect for those seeking an Android app to keep track of expenses, set budgets, and monitor financial goals in a straightforward way.

Why Choose This App

This app provides a comprehensive set of app features that simplify money management and enhance financial awareness.

Its seamless app experience and secure bank integration make it a trusted choice for users looking for an effective Android app to handle daily finances.

Pros

Intuitive User Interface

The app's clean design makes navigation simple for users of all tech levels.

Comprehensive Budget Tracking

It effectively categorizes expenses, helping users monitor their spending habits.

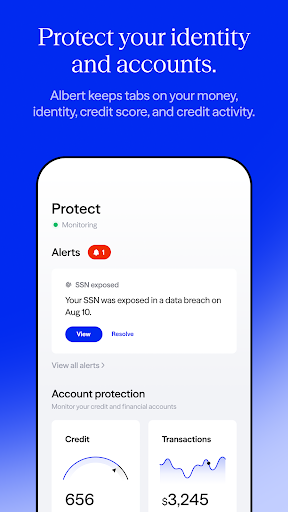

Secure Data Handling

Uses robust encryption to ensure user financial data remains protected.

Bank Integration Support

Supports multiple bank accounts for a consolidated financial overview.

Customizable Budget Goals

Allows users to set personal financial targets and receive progress updates.

Cons

Limited Export Options (impact: Medium)

Currently restricted to CSV format; additional formats like PDF would enhance usability.

Occasional Sync Delays (impact: Medium)

Bank transactions may take a few hours to appear, which can impact real-time tracking.

Lack of Investment Features (impact: Low)

No tools for tracking investments, but future updates are expected to include this.

Basic Customization Settings (impact: Low)

Customization options are somewhat limited; more themes and layout choices could improve user experience.

Offline Functionality Constraints (impact: Low)

Some features are limited offline, but offline mode should be expanded in future versions.

Albert: Budgeting and Banking

Version 10.0.23 Updated 2025-12-12

Ratings:

Downloads:

Age:

Frequently Asked Questions

Is Albert: Budgeting and Banking safe to use on my mobile device?

Yes, Albert is a trusted app that prioritizes your security. The developers use industry-standard encryption to protect your personal and financial information, ensuring your data stays safe when using this mobile app.

Regular updates and security protocols help maintain a trustworthy experience. You can feel confident that your financial information is secure while managing budgets and banking tasks through this app-based solution.

How do I log into Albert on my Android device?

Getting started with Albert on your Android app is straightforward. You'll need to create an account using your email or connect your banking details directly within the app to access your financial data easily.

The login process is secure and designed to give you quick access to your budgeting and banking features, providing a smooth app experience from the moment you sign in.

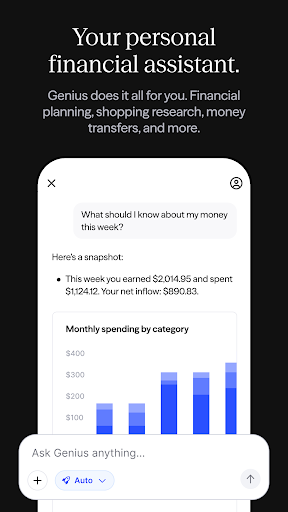

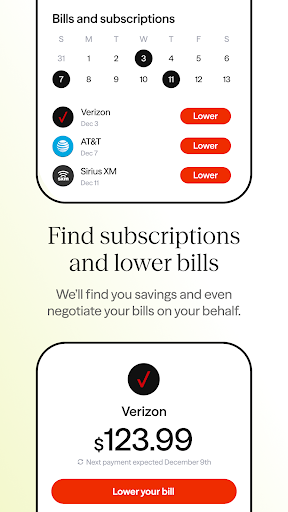

What features does Albert offer as a budgeting and banking app?

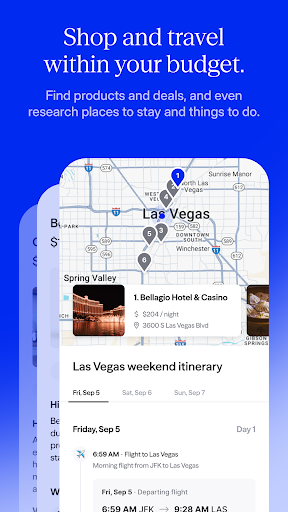

Albert boasts a range of app features designed to simplify your finances. From tracking expenses to setting savings goals, it provides a comprehensive app experience for managing your money effectively.

As a multifunctional mobile app, Albert offers features like bill reminders, investment insights, and account categorization, making it a versatile launcher app for your financial needs.

Can I use Albert on my iPhone and Android device?

Absolutely, Albert is available as a mobile app for both iOS and Android platforms. Whether you prefer an Apple device or an Android app, you can access the same reliable app features for budgeting and banking.

This cross-platform functionality ensures you always have your financial tools at hand, providing a consistent app experience across devices.

Is the Albert app based solution suitable for beginners?

Yes, Albert is designed to be user-friendly, making it a great app-based solution for beginners learning to manage their finances. Its intuitive interface guides you through budgeting and banking tasks without hassle.

With helpful tips and clear app features, even those new to financial management can quickly get up and running, gaining confidence in their financial decisions.

Does Albert provide customer support if I encounter issues?

Albert offers comprehensive customer support to assist users with any problems. You can access help through in-app chat, email, or their website, ensuring your trustworthiness is maintained during your app experience.

This commitment to support makes it easier for you to navigate the app and resolve issues promptly, enhancing your confidence in using this app-based financial solution.

Are there any safety concerns when using the Albert mobile app?

Security is a priority for the developers of Albert. The app uses advanced encryption to keep your banking information safe, and the company adheres to strict privacy standards to build user trustworthiness.

Always ensure your device's security features are updated, and avoid sharing sensitive info. With these precautions, you can enjoy your app experience confidently on your mobile device.

How frequently is the Albert app updated to improve features and security?

The Albert team regularly releases updates to enhance app features and security. These updates ensure you get the latest improvements in your app-based solution, providing a seamless app experience.

Keeping your mobile app updated helps protect your financial data, making sure you're always using a secure and reliable platform for managing your finances.