Ally: Bank, Auto & Invest

Ally: Bank, Auto & Invest App Info

-

App Name

Ally: Bank, Auto & Invest

-

Price

Free

-

Developer

Ally Financial

-

Category

Finance -

Updated

2026-01-14

-

Version

25.24.0

Core Features

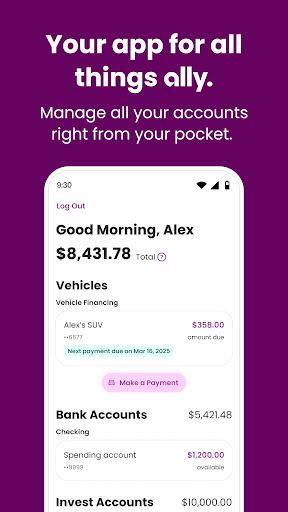

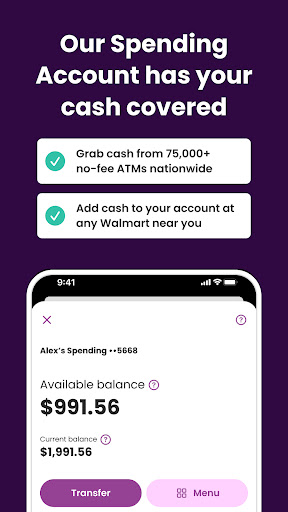

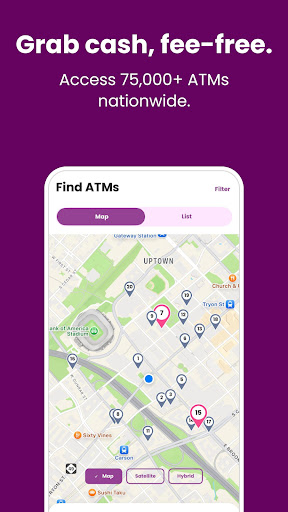

- The app features a secure and user-friendly interface for managing multiple bank accounts in one place.

- Real-time sync ensures your financial data is always current across your devices, enhancing the app experience.

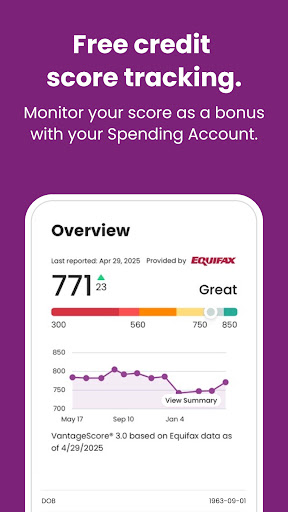

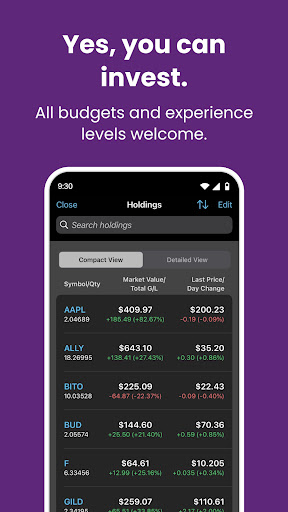

- Integrated auto-investment tools help users grow savings with minimal effort, making it an excellent app-based solution.

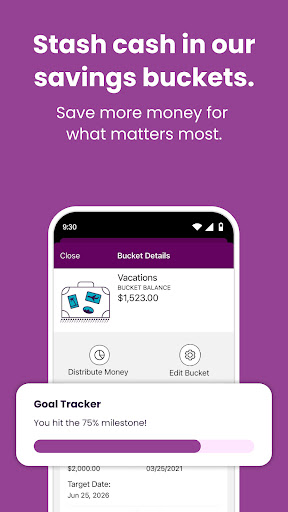

- Customizable notifications keep you updated on transactions and budget goals for smarter money management.

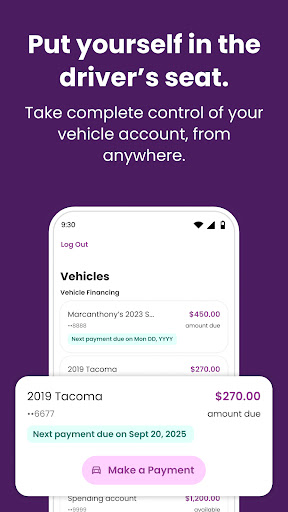

- The app offers comprehensive auto loan and auto insurance management features, streamlining your auto-related finances.

- Intuitive navigation and search functions improve accessibility, making this Android app easy for everyone to use.

- Secure login options and encryption build trust and ensure your sensitive information stays protected.

Who This App Is For

This mobile app is ideal for individuals aged 18-45 who want a comprehensive yet easy-to-use finance solution on their Android device. It suits tech-savvy users looking for a trustworthy way to handle banking and investments.

Whether you're managing daily expenses, saving for future goals, or handling auto-related finances, this app-based solution offers the tools you need for smarter money choices and better financial control.

Why Choose This App

This Android app stands out with its seamless app experience and robust app features designed for convenience and security. It simplifies complex financial tasks into manageable steps, making personal finance easier for everyone.

By integrating multiple financial functions into one platform, it provides a trusted app-based solution that saves time, offers real-time updates, and supports smarter financial decisions that fit your lifestyle.

Pros

Comprehensive financial management tools

Allows users to manage banking, auto financing, and investments all in one app, improving convenience.

User-friendly interface

Intuitive design makes navigation easy, even for beginners.

Strong security features

Utilizes advanced encryption and multi-factor authentication to protect user data.

Personalized financial insights

Provides tailored recommendations to help users optimize their financial strategies.

Robust customer support

Accessible support channels ensure timely assistance for user queries.

Cons

Limited investment options (impact: medium)

Currently offers a narrower range of investment products compared to specialized platforms, which may limit diversification.

App load times could improve (impact: low)

Some users experience slight delays when opening complex features, but official updates aim to optimize performance.

Auto loan features are basic (impact: low)

Lacks advanced tools like loan calculators or detailed amortization schedules that some competitors offer.

Notification settings can be confusing (impact: low)

Users report difficulty customizing alerts; improvements are expected in future updates.

Limited international banking options (impact: medium)

Mostly focused on domestic services, which may inconvenience international users, but plans for expansion are stated.

Ally: Bank, Auto & Invest

Version 25.24.0 Updated 2026-01-14

Ratings:

Downloads:

Age:

Frequently Asked Questions

How do I log in to the Ally: Bank, Auto & Invest mobile app?

Logging into the Ally mobile app is straightforward. Simply open the app, enter your username and password, and you'll gain access to your account securely. If you haven't set up your login yet, follow the prompts to enroll.

The app features an intuitive login process designed for quick access, allowing you to manage your finances on your Android device without hassle. Rest assured, your data is protected with top-tier security measures, making your app experience safe and reliable.

Is the Ally app safe to use on my Android device?

Yes, the Ally mobile app is designed with strong security protocols to protect your personal and financial information on your Android device. It uses encryption and multi-factor authentication to keep your data safe.

As an established app-based solution in the finance category, Ally prioritizes user safety. Regular updates help patch vulnerabilities, ensuring that your app experience remains trustworthy and secure over time.

What are the main features of the Ally app?

The Ally app offers a variety of features including checking your account balance, transferring funds, investing, and managing auto loans. Its user-friendly interface makes it easy to navigate and understand your finances anytime, anywhere.

This app features real-time updates and secure messaging, giving you an app experience that feels seamless and reliable. Whether you're tracking investments or paying bills, the app is built to serve your financial needs efficiently.

Can I use the Ally app as a launcher app on my Android device?

While the Ally mobile app is primarily a financial management tool, it functions as a standalone app that can be added to your Android device's home screen for quick access. It's not designed as a launcher app but integrates smoothly with your device's home screen for convenience.

This setup allows you to open the app directly from your launcher, providing a streamlined app experience tailored to your financial activities without cluttering your device's interface.

How frequently is the app updated, and does it support the latest Android versions?

The Ally app receives regular updates to enhance security, add new features, and improve stability. These updates ensure that the app remains compatible with the latest Android versions and devices.

Staying current with app updates is essential for a secure and seamless app experience. The developer's commitment to maintaining the app confirms its reliability as a trusted app-based solution for managing finances on your Android device.