Bright Money - AI Debt Manager

Bright Money - AI Debt Manager App Info

-

App Name

Bright Money - AI Debt Manager

-

Price

Free

-

Developer

Bright Money

-

Category

Finance -

Updated

2025-12-02

-

Version

1.58.3

Core Features

- The app features AI-powered debt management tools that help users create personalized repayment plans easily.

- It offers real-time sync across devices, ensuring your financial data is always up-to-date and accessible.

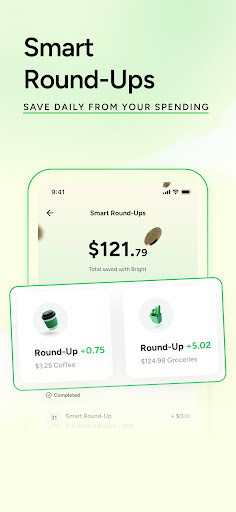

- With its intuitive interface, the app simplifies budget tracking and expense categorization for better financial control.

- The app provides automated alerts and reminders to keep users on track with debt payments and savings goals.

- It includes secure login and encryption, ensuring your sensitive financial information stays trustworthy and private.

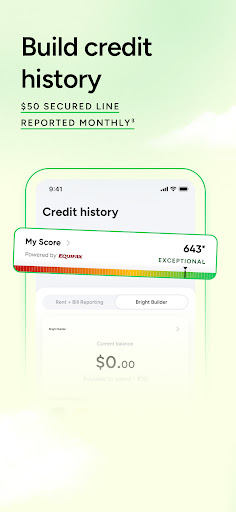

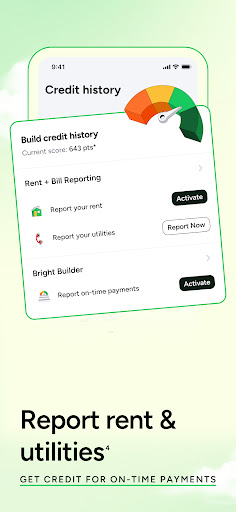

- App features such as credit score monitoring and financial insights help users stay informed about their financial health.

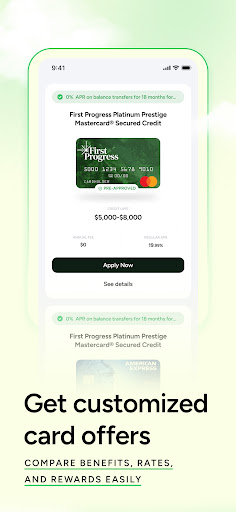

- Designed as an app-based solution, it integrates seamlessly with your existing financial accounts for a comprehensive view.

Who This App Is For

This mobile app is ideal for individuals looking to manage their debt and improve their financial habits. It suits people of all ages who prefer an easy-to-use app experience to stay organized and on top of payments.

Whether you're a busy professional, recent graduate, or someone seeking an effective app-based solution for personal finance, this Android app helps you achieve your financial goals conveniently and reliably.

Why Choose This App

This app offers a smart and user-friendly app experience with advanced AI features that make debt management straightforward. It stands out for its secure, comprehensive approach to personal finance.

By providing real-time insights and personalized recommendations, this Android app helps users solve common financial problems and stands out among alternative solutions for its simplicity and reliability.

Pros

AI-Powered Debt Management

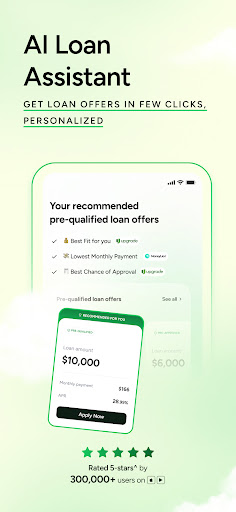

Bright Money uses advanced AI algorithms to optimize debt repayment strategies effectively.

Personalized Financial Planning

The app tailors debt repayment plans based on individual user financial data for better outcomes.

User-Friendly Interface

Bright Money offers an intuitive design that makes managing debts accessible for users with varying tech skills.

Progress Tracking and Insights

It provides detailed insights and progress updates to motivate users and help them stay on course.

Integration with Bank Accounts

Seamless bank account linking allows automatic updates and smoother debt management processes.

Cons

Limited Free Features (impact: medium)

Many advanced features are behind a paywall, which might be a barrier for some users.

Dependence on Internet Connectivity (impact: high)

The app requires a stable internet connection for real-time updates, which may be inconvenient in low-signal areas.

Data Privacy Concerns (impact: medium)

Some users may worry about the handling of sensitive financial data, although official policies are in place.

Limited Support for Certain Banks (impact: low)

Compatibility issues may occur with some smaller or newer bank accounts, but updates are in progress.

Learning Curve for Advanced Features (impact: low)

New users may need some time to fully utilize the app's AI tools and customization options, though tutorials are provided.

Bright Money - AI Debt Manager

Version 1.58.3 Updated 2025-12-02

Ratings:

Downloads:

Age:

Frequently Asked Questions

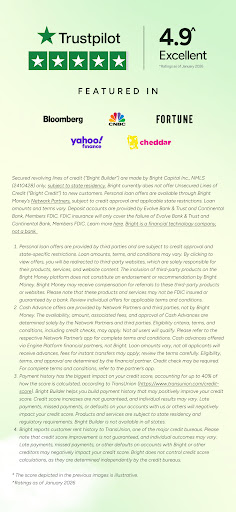

Is Bright Money - AI Debt Manager safe to use?

Yes, Bright Money is a trusted finance app that prioritizes user data safety. It employs industry-standard security measures to protect your personal and financial information, ensuring your privacy is maintained at all times.

As an app based solution designed for debt management, it complies with relevant regulations and offers transparency about data handling. You can feel confident using this mobile app to manage your finances safely.

How do I log into Bright Money on my Android device?

To access the Bright Money Android app, you'll need to download and install it from the Google Play Store. Once installed, open the app and follow the prompts to sign in with your existing account or create a new one.

The user experience is smooth and straightforward, making it easy for new users to get started. The app features an intuitive interface that guides you through all necessary steps for secure login.

Are there any specific app features that help with debt management?

Bright Money offers a range of app features designed to help you control and pay off debt efficiently. These include personalized budgeting tools, automated payment reminders, and an AI-driven algorithm that suggests optimized repayment plans.

Using this app based solution, you gain real-time insights into your financial health and tailored advice, making it easier to stay on track and build healthier money habits.

Can I use Bright Money without an internet connection?

The core features of Bright Money are best experienced with an internet connection, especially for syncing data and accessing real-time updates. However, some basic functions like viewing stored budget info may be available offline.

For a seamless app experience, it's recommended to stay connected. This ensures that your debt management plan stays up to date and accurate across your device.

Is Bright Money suitable for all types of debt?

Yes, Bright Money is designed to assist with various kinds of debt, including credit cards, personal loans, and student loans. Its app features allow you to create customized repayment strategies tailored to your financial situation.

As an app based solution offering expert advice, it helps users develop clear plans to pay off debt faster and reduce interest costs, making it a versatile tool for managing different debt types.

What makes Bright Money stand out from other finance apps?

Bright Money's app experience is powered by AI technology that personalizes debt repayment and budgeting advice based on your unique finances. Its app features include automated suggestions and progress tracking, making debt management more straightforward.

Being a reliable Android app and launcher app for financial health, it provides real-world solutions aimed at improving your financial stability with trusted insights and user-friendly design.

Is the app based solution suitable for beginners in finance?

Absolutely. Bright Money is designed with simplicity in mind, making it accessible to users new to managing debt or personal finances. Its helpful app features and guided tutorials empower beginners to take control without feeling overwhelmed.

The app experience emphasizes clarity and support, ensuring that even those unfamiliar with financial terminology can benefit from its insights and tools.

How often is the app updated, and does it improve over time?

Bright Money receives regular updates that enhance the app features and overall user experience. Developers continuously work to refine its functionality, incorporate user feedback, and add new capabilities to better serve users.

This commitment to improvement ensures that your experience with this app based solution remains reliable and that the app stays aligned with the latest financial technology standards.