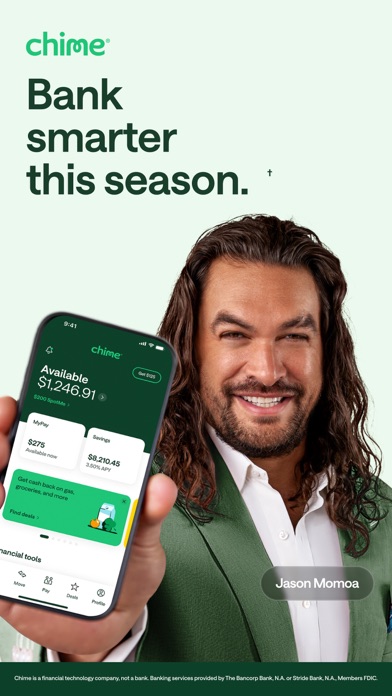

Chime – Mobile Banking

Chime – Mobile Banking App Info

-

App Name

Chime – Mobile Banking

-

Price

Free

-

Developer

Chime

-

Category

Finance -

Updated

2025-12-16

-

Version

5.305.0

Core Features

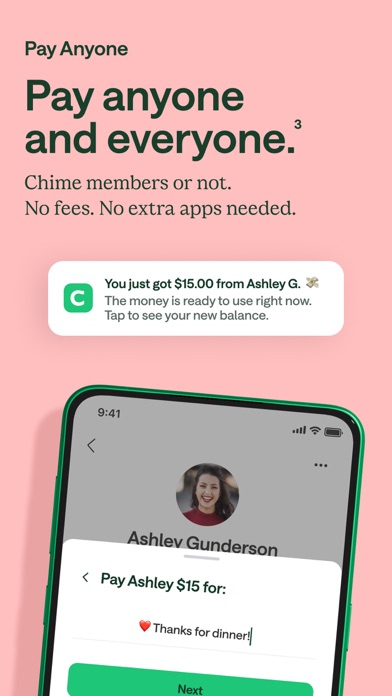

- The app features secure mobile banking capabilities, allowing users to manage accounts safely from their devices.

- Real-time transaction updates ensure users stay informed about their finances instantly and accurately.

- In-app checks and account monitoring help prevent fraud and unauthorized access, enhancing trustworthiness.

- Easy fund transfers and bill payments streamline everyday banking activities with user-friendly app features.

- Personalized budgeting tools assist users in tracking expenses and saving more effectively within the app experience.

- Support for Android app and iOS ensures a consistent, seamless experience across multiple devices and platforms.

Who This App Is For

This mobile app is ideal for young professionals, busy families, and anyone seeking a modern, convenient way to handle their finances on the go.

Whether you're managing daily expenses or planning for future savings, this app-based solution offers a straightforward way to stay on top of your money anytime, anywhere.

Why Choose This App

This Android app stands out for its secure, easy-to-use app features designed to improve your financial management and security.

Its reliable app experience and comprehensive app features make it a top choice for those looking for a trusted, efficient mobile banking solution that adapts to their lifestyle.

Pros

User-Friendly Interface

The app offers an intuitive and easy-to-navigate design, making banking accessible for all users.

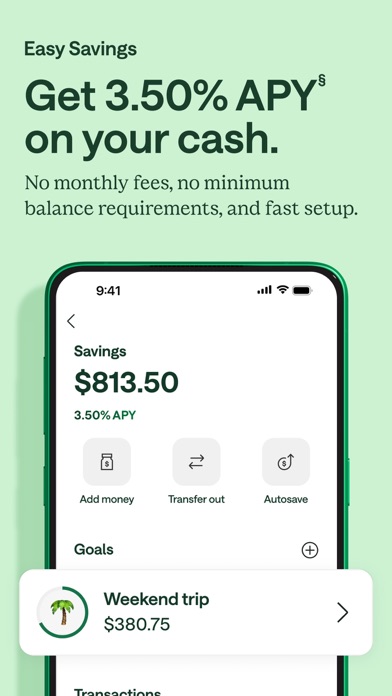

No Monthly Fees

Chime provides free checking accounts without monthly maintenance charges, saving users money.

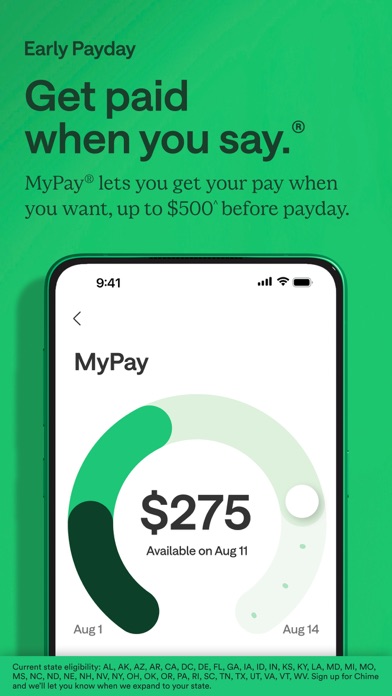

Early Direct Deposit

Users can receive their paychecks up to two days earlier, improving cash flow management.

Automatic Savings Feature

The app allows users to automatically save a percentage of each deposit, promoting financial discipline.

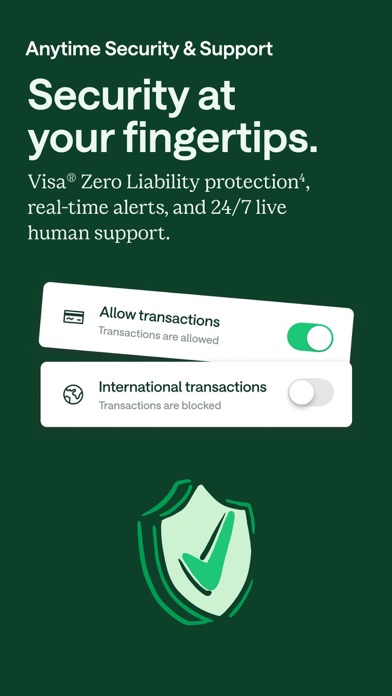

Real-Time Alerts

Instant notifications about transactions help users monitor their account activity closely.

Cons

Limited Investment Options (impact: low)

Chime focuses mainly on banking services and does not offer investment products, which may restrict wealth-building options.

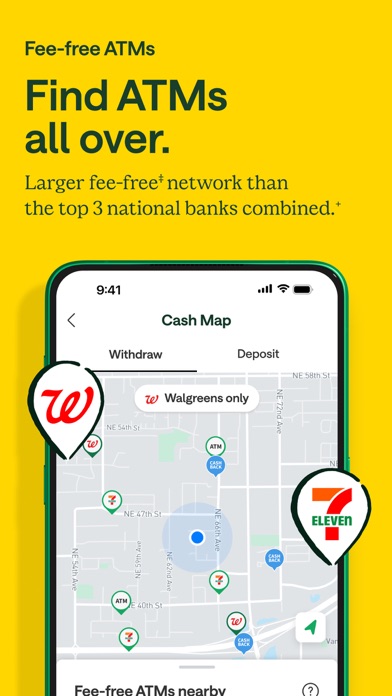

No Physical Branches (impact: medium)

All services are digital, which might be inconvenient for users who prefer in-person banking; a temporary offline solution could be visiting partner ATMs or kiosk services.

Customer Support Wait Times (impact: medium)

Support responses can sometimes be slow during peak hours; improved live chat availability or enhanced FAQ sections are expected in future updates.

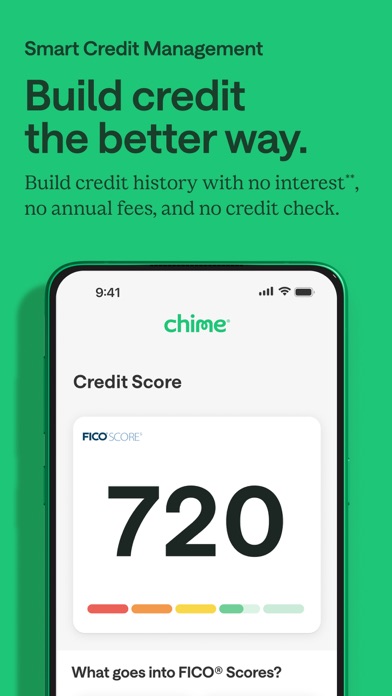

Limited Credit Building Features (impact: low)

Chime doesn't currently offer credit-building tools or credit score tracking, but integration with credit bureaus may be planned.

No International Transactions (impact: low)

The app is primarily designed for U.S. users, and international use is limited; future updates may include international support or partnered ATM networks.

Chime – Mobile Banking

Version 5.305.0 Updated 2025-12-16

Frequently Asked Questions

Is the Chime mobile app safe to use?

Yes, the Chime app is designed with security in mind. It uses encryption and advanced security measures to protect your personal and financial information. This makes it a trusted app-based solution for managing your finances.

Chime is regulated by financial authorities and continuously updates its security protocols. Always ensure you download apps from official sources like the Google Play Store or Apple App Store to keep your data safe.

How do I set up my account on the Chime Android app?

Getting started with the Chime mobile app is straightforward. After installing the app from your device's app store, you'll need to provide some basic information, such as your name and SSN, to verify your identity.

The app features an intuitive interface, making it easy to navigate through account setup. Once completed, you can start enjoying the app experience with features like automatic savings and real-time transaction alerts.

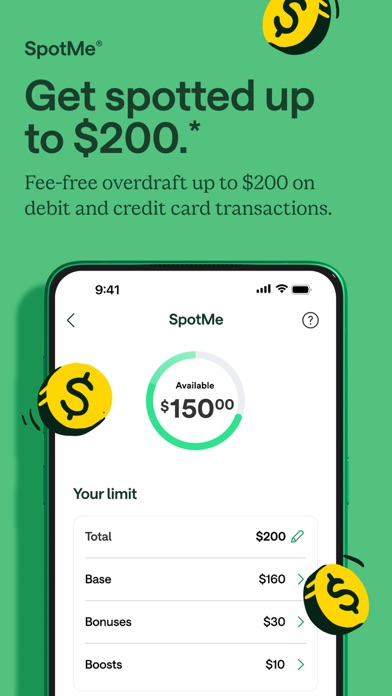

What features does the Chime app offer?

The Chime app includes several useful app features designed to make managing your money easier. These include no-fee overdraft protection, automatic savings, and real-time transaction alerts, all accessible through this innovative mobile app.

As a versatile launcher app for your financial needs, Chime provides a seamless app experience that helps you keep track of your spending and savings. The app provides a convenient app based solution tailored to everyday financial management.

Which devices are compatible with the Chime mobile app?

The Chime app works well on most modern Android devices and iPhones. You simply need to have a compatible Android OS version or iOS to ensure smooth operation and access to all app features.

Since it is a mobile app, it provides an optimized app experience whether you're on your smartphone or tablet. The app's compatibility makes it a reliable app-based solution for a wide user base.

Can I use Chime as a launcher app for my financial management?

While Chime is primarily a mobile banking app, it serves as a launching pad for your financial activities. Its user-friendly interface acts as a launcher app for your daily financial transactions and savings goals.

With features like direct deposit setup and spending insights, it provides a comprehensive app experience that supports your money management needs in an easy-to-navigate platform.

What should I do if I encounter issues with the Chime app?

If you face problems with the Chime mobile app, first try restarting your device or updating the app to the latest version. You can also check the app's official support or FAQs for troubleshooting tips.

Customer support is available for more complex issues, and they prioritize maintaining a trustworthy app environment. Ensuring your device's security settings and app permissions are correct helps keep the app experience smooth.

Is the Chime app suitable for new users unfamiliar with mobile banking?

Absolutely, the Chime app is designed to be user-friendly, making it a good app-based solution for beginners. Its simple interface guides you through the features, helping you start managing your finances easily.

As an experienced provider of financial services, Chime offers a trustworthy app experience that emphasizes transparency and security, which is especially important for users new to mobile banking.

How often is the Chime app updated to improve performance?

The Chime mobile app is regularly updated to enhance app features, security, and overall app experience. These updates are designed to keep the app reliable and safe, providing trustworthiness for users.

Staying current with updates ensures you have access to latest app features and improvements, making it a dependable app-based solution for your financial management needs.