Classic Netspend

Classic Netspend App Info

-

App Name

Classic Netspend

-

Price

Free

-

Developer

NetSpend

-

Category

Finance -

Updated

2025-12-08

-

Version

7.0.4

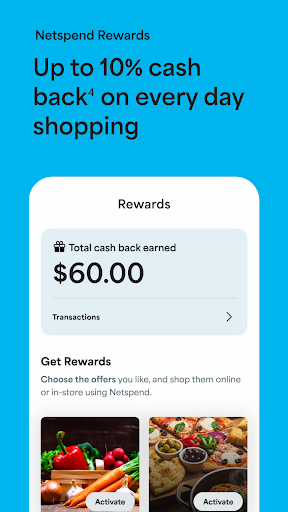

Core Features

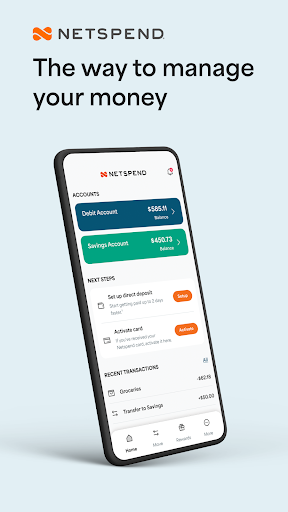

- The app features a secure mobile wallet that allows users to manage and monitor their finances easily in one place.

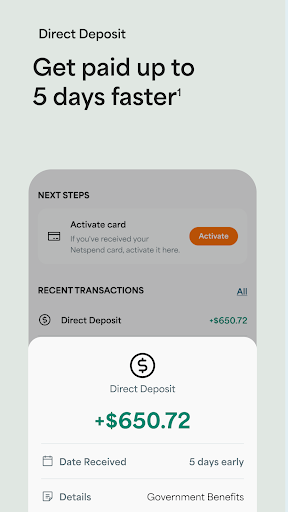

- Real-time transaction alerts keep users updated instantly on spending, promoting better financial control.

- Intuitive UI ensures smooth navigation, making it simple for users to access various app features without hassle.

- The app includes bill pay options, enabling users to settle bills directly within the app in a few taps.

- Offline mode is available, allowing users to view account details and recent transactions without internet access.

- Integration with popular payment networks ensures quick transfers and seamless fund management.

- Custom spending alerts help users stay within budget, delivering a personalized app experience for financial safety.

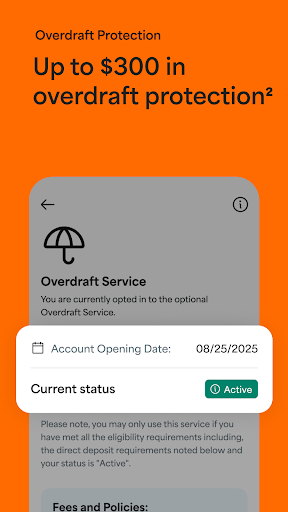

- Secure login options and encryption demonstrate the app's commitment to trustworthiness and privacy protection.

Who This App Is For

This mobile app is ideal for individuals who want a reliable and easy-to-use app-based solution for managing their finances on Android devices. It benefits those seeking a straightforward app experience for daily transactions and budget tracking.

Whether you're a busy professional, a student, or someone who prefers to handle finances digitally, this app is perfect for real-world scenarios like paying bills, checking balances, or tracking expenses anytime, anywhere.

Why Choose This App

This Android app offers a comprehensive set of app features that enhance your overall financial management. Its focus on security and user-friendly design makes it a trustworthy choice among finance apps.

What sets it apart is its ability to deliver a seamless app experience with features tailored to everyday needs, providing a practical and efficient app-based solution for managing money comfortably and safely.

Pros

User-Friendly Interface

The app offers an intuitive and easy-to-navigate design, making account management simple for users of all ages.

Wide Acceptance

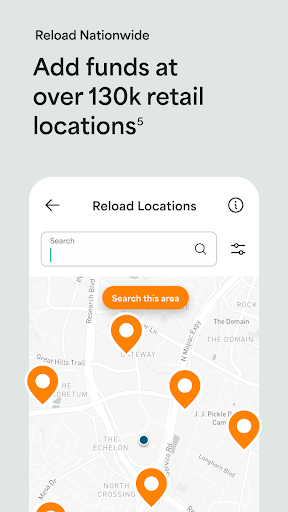

Classic Netspend cards are widely accepted at various merchants and ATMs nationwide, increasing convenience.

Real-Time Monitoring

Users can track transactions instantly, helping to manage finances effectively and prevent fraud.

No Credit Check Requirement

Applying for a Netspend card does not require a credit check, making it accessible to a broader audience.

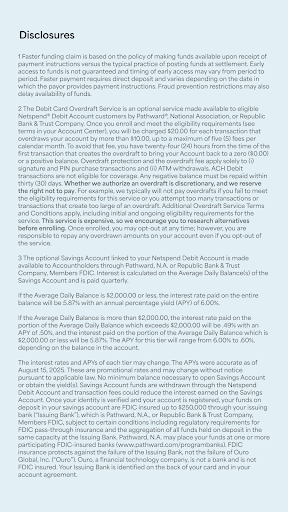

Various Fee Options

The app provides clear fee structures and options for reloads and withdrawals, allowing users to select plans suited to their needs.

Cons

Limited Customer Support Options (impact: Medium)

Customer support is primarily through online forms and limited phone hours, which can delay issue resolution.

Recharge Fees at Retail Locations (impact: Low)

Reloading funds at some retail stores may incur fees; users can check fee schedules ahead of time to avoid surprises.

App Performance Occasionally Slow (impact: Medium)

Some users report occasional lag or crashes; app updates are expected to improve stability over time.

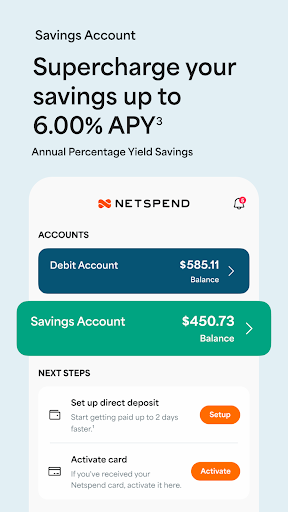

Limited Investment or Saving Features (impact: Low)

The app primarily focuses on prepaid card management without integrated savings or investment tools, which may limit financial growth options.

No Digital Wallet Integration (impact: Low)

Currently, the app does not support linking with popular digital wallets like Apple Pay or Google Pay, but official updates may include this feature in the future.

Classic Netspend

Version 7.0.4 Updated 2025-12-08

Ratings:

Downloads:

Age:

Frequently Asked Questions

How do I log into the Classic Netspend mobile app?

To log into the Classic Netspend app, simply open the app on your Android device and enter your login credentials. The app offers an intuitive interface that makes accessing your account straightforward. Ensure you have a stable internet connection to avoid login issues. If you're a first-time user, you'll need to create an account using your personal details. Once registered, familiarizing yourself with the app features can help you manage your finances more efficiently. The app experience is designed to be quick and seamless, giving you full control of your accounts anytime.

Is the Classic Netspend app safe to use on my device?

Absolutely, the Classic Netspend mobile app prioritizes your security. It uses encryption protocols to protect your personal and financial information. The app is regularly updated to maintain high safety standards, making it a reliable app based solution for managing money. Always ensure you download the app from trusted sources like the Google Play Store to avoid counterfeit versions. Using a secure password and enabling two-factor authentication can further enhance your safety while using this Android app.

What features are included in the Classic Netspend app?

The app features include real-time account monitoring, fund transfers, and balance checks. You can also access transaction histories and manage your card settings directly within the app. These features aim to provide an extensive app experience that simplifies financial management. Additionally, the app supports setting up alerts for your account, helping you stay on top of spending and deposits. Whether you're using it as a launcher app or a dedicated finance tool, its comprehensive features are designed to boost your convenience.

Does the Classic Netspend app work on all Android devices?

The Classic Netspend app is designed to be compatible with most Android devices, ensuring a broad app experience for users. You should have no trouble installing it from the Google Play Store on compatible Android smartphones and tablets. However, for optimal performance, it's recommended to keep your device updated with the latest Android version. This helps prevent any potential bugs and ensures the app features run smoothly, giving you a reliable app-based solution.

Can I use the Classic Netspend app as a launcher app or only for finance management?

The primary purpose of the Classic Netspend app is for managing your finances, but it functions smoothly as an app-based solution tailored to your banking needs. Although it is not specifically designed as a launcher app, its user interface is optimized for quick access to account features. If you're looking for a do-it-all launcher app, this might not be the best fit. However, if your goal is straightforward financial management with an easy-to-use app experience, this app excels in delivering on those features.

Are there any fees for using the Classic Netspend mobile app?

The app itself is free to download and install from the Google Play Store. However, some financial transactions or certain features within the app may incur fees, depending on your account type and activity. It's always a good idea to review your account terms and app features to understand any potential costs. By doing so, you can make the most of this app-based solution while keeping your financial management transparent and straightforward.

How do I update the Classic Netspend app to the latest version?

To keep enjoying the best app experience, ensure you regularly update the Classic Netspend mobile app through the Google Play Store. Updates often include bug fixes, security enhancements, and new features to improve your app features. Simply visit the store, go to your installed apps, and check for updates. Updating the app helps maintain its reliability and security, ensuring your app-based solution is always running smoothly on your Android device.

What should I do if I forget my login details for the app?

If you forget your login credentials, you can select the 'forgot password' option on the login page. The app will guide you through the steps to reset your password using your registered email or phone number. This ensures a secure process to regain access. For added security, ensure your contact details are up to date. Once you regain access, review your account activity for any suspicious transactions and update your password to keep your app experience safe and trustworthy.