DailyPay On-Demand Pay

DailyPay On-Demand Pay App Info

-

App Name

DailyPay On-Demand Pay

-

Price

Free

-

Developer

DailyPay Inc

-

Category

Finance -

Updated

2026-01-20

-

Version

40.0.0

Core Features

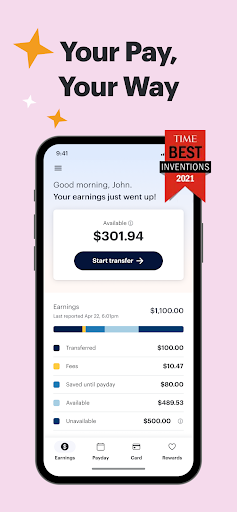

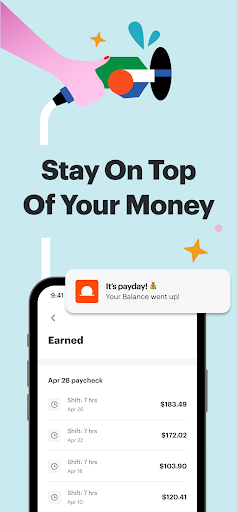

- The app features instant on-demand pay options, allowing users to access earned wages before payday easily.

- Secure financial transactions are a key app feature, ensuring user data and funds are protected at all times.

- Real-time sync across devices provides seamless tracking of earnings and payment history for better financial management.

- The app offers a user-friendly interface tailored for quick navigation, enhancing overall app experience.

- Integration with bank accounts and debit cards makes transferring funds simple and stress-free.

- Notifications keep users updated on available earnings and upcoming withdrawals, improving financial awareness.

- This Android app includes customizable features to suit individual financial preferences and needs.

Who This App Is For

This mobile app benefits working professionals, gig economy workers, and anyone seeking flexible access to their earnings. It's especially useful for those who prefer an app-based solution for quick financial relief.

Ideal for users managing irregular income or needing short-term cash flow, this app offers a convenient app experience for tracking and accessing wages on the go.

Why Choose This App

This Android app stands out by providing a reliable app-based solution that offers fast, secure access to earned wages, helping users stay in control of their finances.

Its comprehensive app features and smooth app experience make it a top choice for anyone looking for a practical, trustworthy mobile banking supplement with on-demand pay capabilities.

Pros

Instant Access to Earned Wages

Users can access their earned wages anytime before their payday, providing financial flexibility.

Low or No Fees for Basic Transfers

Most transactions are free or have minimal fees, saving users money compared to traditional payday lending.

User-Friendly Interface

The app offers an intuitive design, making it easy for users to navigate and manage their funds effortlessly.

Integration with Employers

Seamless integration allows employers to offer this benefit directly, enhancing employee satisfaction.

Financial Wellness Tools

Includes budgeting features and financial education resources to help users manage their money better.

Cons

Limited Availability of Funds (impact: medium)

The app may not always have enough funds to cover all user requests instantly, especially during high demand.

Potential for Overuse (impact: medium)

Frequent use might lead users to rely heavily on on-demand pay, risking overspending or debt accumulation.

Transition Time for Bank Transfers (impact: low)

Bank transfers can sometimes take a few hours to process, which may inconvenience urgent needs; official improvements are underway.

Limited International Support (impact: low)

Currently, the app's service is primarily available within specific regions, restricting global users; future expansion is planned.

Customer Support Delays (impact: low)

Response times for customer inquiries can occasionally be slow; users can try using in-app chat for faster assistance or check FAQs for common issues.

DailyPay On-Demand Pay

Version 40.0.0 Updated 2026-01-20

Ratings:

Downloads:

Age:

Frequently Asked Questions

How do I log into the DailyPay On-Demand Pay app?

To access your account on the DailyPay On-Demand Pay app, simply open the mobile app on your device. If you're using an Android app or another platform, ensure you have the latest version installed for optimal app experience.

Login is straightforward, requiring your details. The app features include secure login options like fingerprint or PIN, which help keep your account safe while providing quick access whenever you need your app based solution for on-demand payments.

Is it safe to use the DailyPay On-Demand Pay app?

Yes, the app is designed with security in mind, using encryption and secure login methods to protect your personal information. DailyPay is a trusted provider in the finance industry, ensuring your data stays private and safe.

Using this mobile app as a solution for on-demand pay can give you peace of mind. Regular updates help maintain security, making it a reliable choice for managing your finances directly from your Android app or other mobile devices.

What features does the DailyPay On-Demand Pay app offer?

The app features include real-time balance updates, instant access to earned wages, and the ability to transfer funds to your bank or debit card. It's designed to offer a seamless app experience for those seeking flexible pay options.

Additional features like transaction history and savings options make it a helpful app based solution for managing your finances. The app serves as a handy launcher app, making financial management more accessible on your mobile device.

Can I use the DailyPay On-Demand Pay app on my Android device?

Absolutely. The DailyPay On-Demand Pay mobile app is available for Android devices, providing a smooth app experience for users on that platform. The app's features are optimized for Android, ensuring performance and ease of use.

If you're looking for a reliable launcher app that integrates well with your Android setup, this app offers useful solutions to access your wages efficiently and securely, making it a practical addition to your mobile app collection.

Are there any costs associated with using the DailyPay On-Demand Pay app?

The app generally charges fees for certain transactions, such as instant transfers or specific app features. However, accessing your account and viewing balances usually come without additional costs.

Using this app based solution can help you manage finances more effectively without overly complicated charges. Always review the fee details within the app to stay informed about your expenses while enjoying a trusted app experience.