GO2bank: Mobile banking

GO2bank: Mobile banking App Info

-

App Name

GO2bank: Mobile banking

-

Price

Free

-

Developer

Green Dot

-

Category

Finance -

Updated

2025-11-08

-

Version

3.0.0

Core Features

- The app features an intuitive dashboard that allows quick access to account balances and recent transactions.

- Secure mobile payments are enabled with advanced encryption to protect user data and transactions.

- Real-time account sync ensures users see the most current information across their devices.

- Budgeting tools help manage expenses effectively with clear categorization and insightful analytics.

- Bill pay functionality simplifies managing recurring payments directly within the app experience.

- The app includes customizable alerts for low balance, upcoming payments, and more, enhancing financial awareness.

- Customer support features such as in-app messaging and FAQs provide trusted assistance easily.

Who This App Is For

This mobile app is ideal for young adults and working professionals who prefer digital banking solutions. It caters to those seeking convenient, on-the-go financial management through an Android app or iOS device.

Whether you want a simple app-based solution for daily banking or need access to comprehensive app features for budgeting and payments, this app suits users who value security, ease of use, and reliable app experience.

Why Choose This App

This app provides a seamless app experience with robust features designed for easy financial control. Its focus on security and real-time updates makes it a trustworthy choice among mobile banking apps.

As an excellent Android app and launcher app for managing finances, it stands out by offering integrated solutions that meet everyday banking needs with simplicity and reliability, solving user problems effectively and efficiently.

Pros

User-friendly interface

The app offers an intuitive design, making it easy for users to navigate and access features quickly.

No-fee banking services

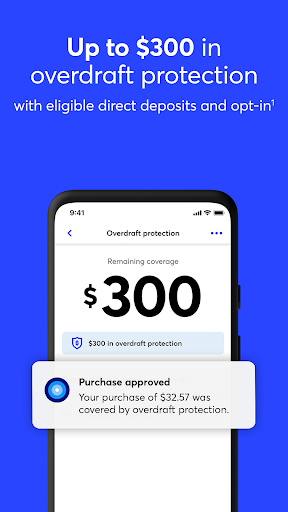

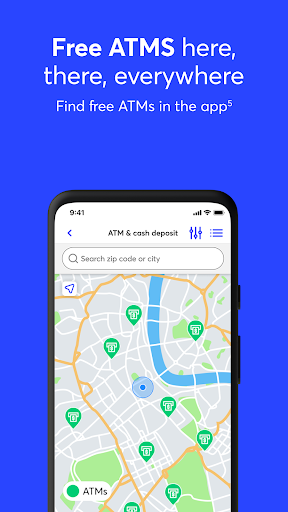

GO2bank provides free checking accounts, ATM access, and no monthly maintenance fees, appealing to budget-conscious users.

Early direct deposit

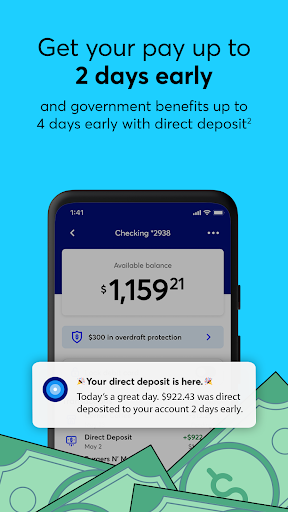

Customers can receive their paycheck up to two days earlier than traditional banks, enhancing cash flow management.

Built-in financial tools

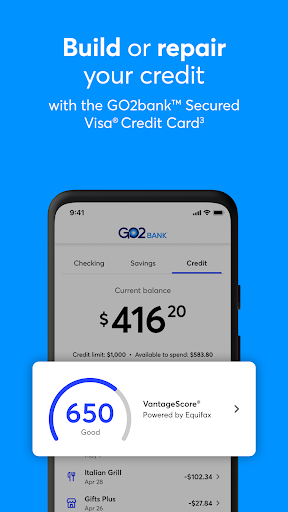

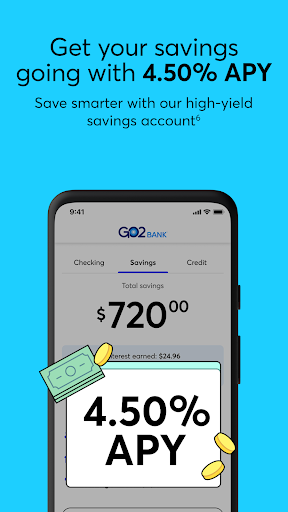

Features like savings goals and budgeting tools help users manage their finances more effectively.

Robust security measures

The app employs multiple layers of security, including biometric login and real-time fraud alerts, ensuring user safety.

Cons

Limited international support (impact: Medium)

The app primarily supports U.S. transactions, which may inconvenience users abroad or those making international transfers.

Customer service availability (impact: Medium)

Customer support is mainly through chat and email, which might result in delays during urgent issues—users can try the FAQ or contact during business hours.

Some features are region-specific (impact: Low)

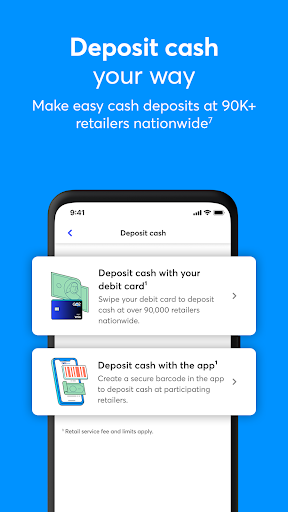

Certain features, like cash deposit options, may not be available in all areas; official app updates are expected to improve coverage.

Limited investment options (impact: Low)

The app currently lacks comprehensive investment tools, but the company has announced plans to expand these features in the future.

Mobile-only access (impact: Low)

There is no desktop platform, which could be inconvenient for users preferring a browser, but the mobile app is regularly updated with new features.

GO2bank: Mobile banking

Version 3.0.0 Updated 2025-11-08