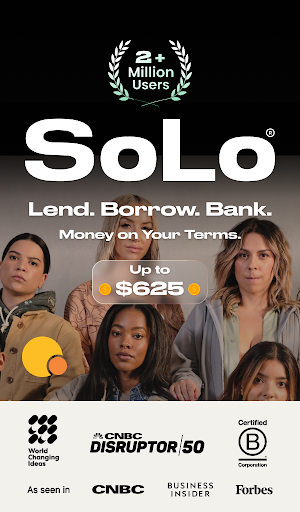

SoLo Funds: Lend & Borrow

SoLo Funds: Lend & Borrow App Info

-

App Name

SoLo Funds: Lend & Borrow

-

Price

Free

-

Developer

Solo Funds

-

Category

Finance -

Updated

2026-01-06

-

Version

2.10.8

Core Features

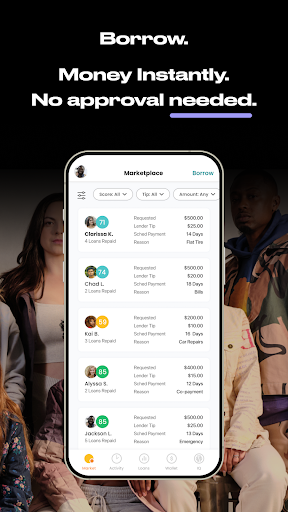

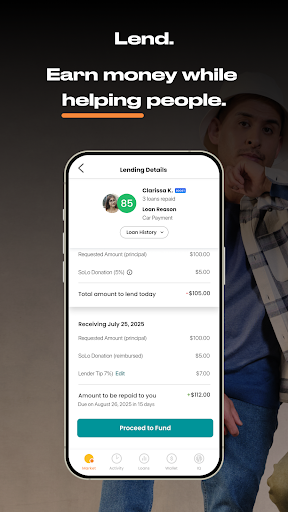

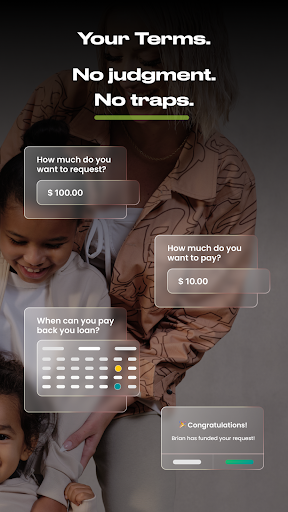

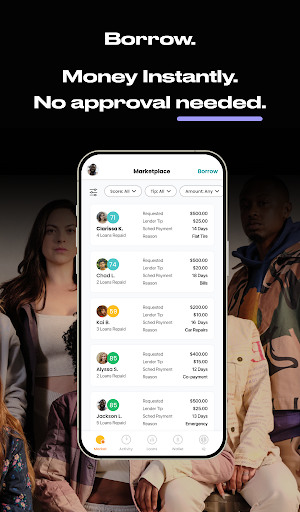

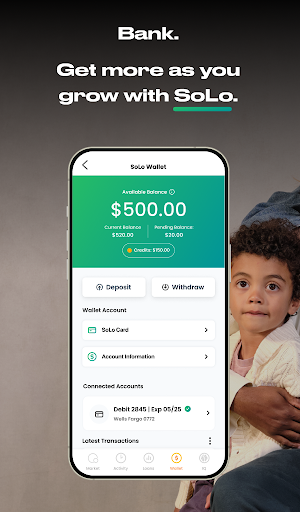

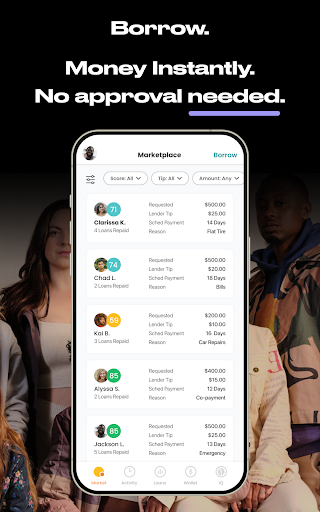

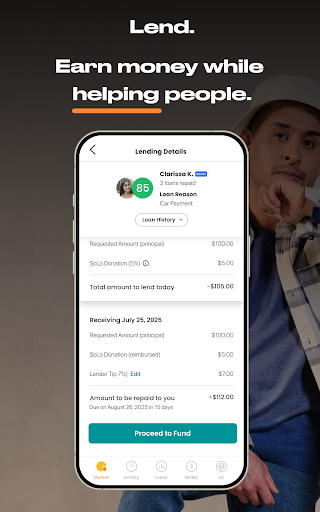

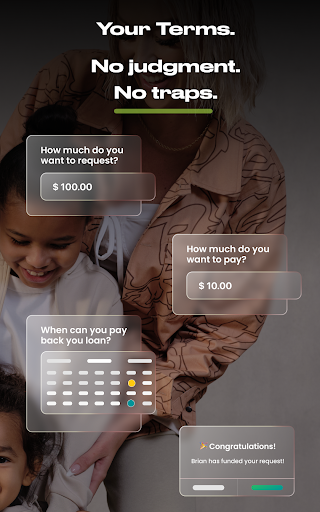

- The app features secure and easy-to-use loan request and lending functions, streamlining the borrowing process.

- Real-time notifications keep users updated on loan approvals, repayments, and messages within the app experience.

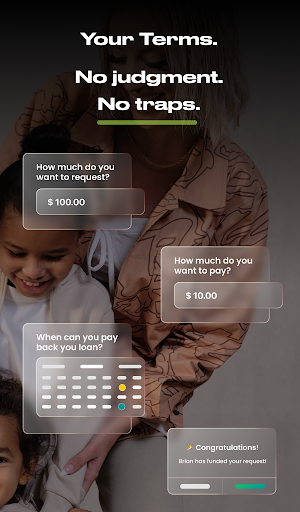

- The app offers flexible repayment options and automatic reminders to help borrowers stay on track.

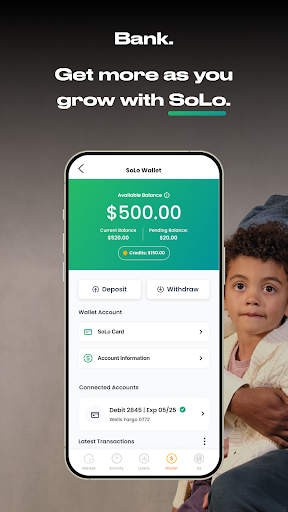

- With built-in credit building tools, users can improve their financial standing over time.

- Simple interface and smooth navigation ensure an intuitive app experience for all users.

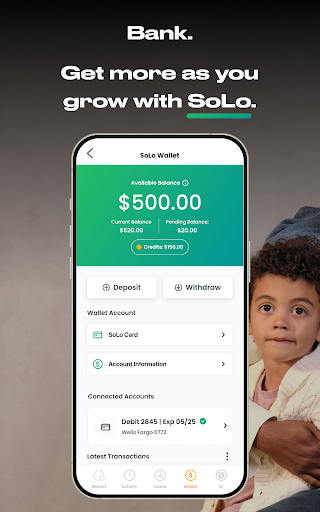

- The app features a robust security system, safeguarding user data and financial transactions.

- Available as both an Android app and a launcher app, it provides seamless access to financial solutions.

Who This App Is For

This mobile app is ideal for individuals aged 18 and above seeking quick, reliable lending or borrowing options. It benefits those who prefer a straightforward app-based solution for managing personal finances.

Whether you need emergency funds or want to earn interest on your savings, this app provides a secure platform to connect with trusted lenders or borrowers in various real-world scenarios.

Why Choose This App

This Android app stands out with its user-friendly interface and comprehensive app features that address common financial needs. It offers an efficient, trustworthy app-based solution for personal borrowing and lending.

By simplifying the lending process and providing real-time updates, it helps users save time and avoid potential scams, making it a reliable choice over other similar apps in the market.

Pros

Easy and user-friendly interface

The app provides a simple navigation experience that makes lending and borrowing straightforward for new users.

Fast repayment options

Borrowers can quickly repay loans through multiple convenient payment methods, improving cash flow management.

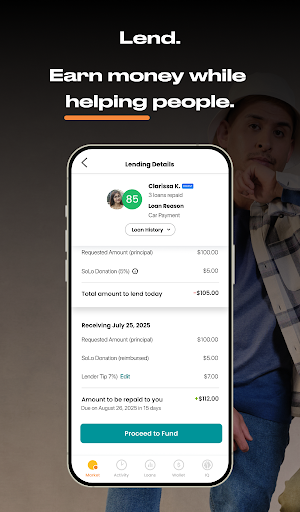

Transparent fee structure

Clear information about interest rates and fees helps users make informed financial decisions.

Wide community of lenders and borrowers

A large user base increases the chances of successful loans and quicker matching.

Credit building opportunities

Participating in the platform can help users improve their credit scores over time.

Cons

Limited loan amount options (impact: medium)

Current maximum loan sizes may be insufficient for users with larger financial needs, but the platform may introduce higher limits in future updates.

Interest rates can be higher than traditional banks (impact: medium)

Some users might find the APRs on loans to be costly, though they are competitive within peer-to-peer lending.

Platform's user verification process could improve (impact: low)

Additional verification steps might increase security, and upcoming updates are expected to enhance this process.

Limited geographical availability (impact: low)

Currently, the app might only serve certain regions, but expansion plans are in progress.

Customer support response times may vary

Users have reported occasional delays in support replies, but the company has announced staffing increases to address this.

SoLo Funds: Lend & Borrow

Version 2.10.8 Updated 2026-01-06

Ratings:

Downloads:

Age:

Frequently Asked Questions

Is SoLo Funds: Lend & Borrow safe to use?

Yes, SoLo Funds is committed to user safety and employs multiple security measures to protect your information. The app operates within a regulated framework, ensuring your data and transactions are secure.

As an experienced platform in the finance category, it maintains transparency and adheres to industry standards. Always use the official app from trusted sources to ensure your app experience remains trustworthy and safe.

How do I sign up and log in to the SoLo Funds app?

Getting started with SoLo Funds is straightforward. You need to download the Android app from the Google Play Store and create an account using your email or social media login. The app features a simple registration process designed for quick access.

Once registered, you can log in anytime using your credentials. This app-based solution makes managing your lending or borrowing activities easy and accessible, enhancing your overall app experience.

What are the main features of SoLo Funds: Lend & Borrow?

This finance mobile app offers a range of features tailored to help users lend or borrow money conveniently. It provides a secure platform for peer-to-peer transactions, with straightforward tools for creating and managing loan requests.

The app features include real-time notifications, repayment tracking, and a user-friendly interface that enhances your app experience. Its intuitive design ensures that both new and experienced users can navigate it with ease.

Can I use SoLo Funds on my Android device without issues?

Absolutely. As an Android app, SoLo Funds is optimized for a smooth app experience on most Android devices. It is designed to run seamlessly, whether on phones or tablets, offering reliable performance across various screen sizes.

If you face any technical problems, updating your device's operating system or reinstalling the app can often resolve issues, ensuring continuous access to this app-based solution without hiccups.

Is SoLo Funds a launcher app or does it require full installation?

SoLo Funds is a full mobile app that needs to be installed on your Android device. It is not a launcher app but functions as a dedicated platform for peer-to-peer lending and borrowing within the finance category.

Once installed, it provides quick access directly from your device's app drawer, delivering an optimized app experience for managing your financial transactions easily.

Does SoLo Funds provide customer support if I have issues?

Yes, SoLo Funds offers customer support to assist with any technical or account-related questions. You can reach out through the app or their official website for help, ensuring your trustworthiness as a platform is maintained.

This responsive support system helps improve your app experience by resolving problems quickly, making it a reliable app-based solution for managing financial transactions confidently.

Is there any safety risk involved with using SoLo Funds?

Using SoLo Funds involves typical safety precautions common in finance apps. The platform employs encryption and security protocols to protect your data. It's important to only access the app through official sources to stay safe.

Given its reputation in the finance category, it prioritizes user trustworthiness by maintaining industry-standard safety measures, making it a safe choice for your app experience as part of your financial toolkit.

Can I access SoLo Funds without an internet connection?

Basic app features such as viewing loan details or managing your account require an active internet connection. However, some functionalities like tracking repayments may be available offline after initial sync.

This app experience is designed to be flexible, allowing you to manage aspects of your lending or borrowing activities even when offline, as long as you have previously synchronized your data.